The cost of living has gone up pretty much everywhere. From grocery bills to rent payments, everyone is feeling the sting of higher prices these days.

Thankfully, there are numerous ways to reduce your living costs if you get a bit savvy. And the best part is that many of these ideas can begin saving or making you extra money to get by today for fast relief.

1. Earn Free PayPal Cash For Buying Groceries

Groceries are a significant part of almost everyone’s budget. But with inflation and living costs on the rise, your weekly food bill is probably looking much steeper these days than just a few years ago.

To combat high food costs, we suggest getting back to basics. This means setting a budget, using coupons, and looking for food savings anywhere you can.

To help you get started, we suggest using these nifty rewards programs:

- InboxDollars: Get paid to upload grocery receipts, shop online, watch videos, and complete other easy tasks.

- Swagbucks: Earn cash back with coupons, local dining deals, online shopping, and by answering surveys and playing games.

- National Consumer Panel: Scan products you buy and answer short surveys to win gift cards, cash, and other prizes.

Between these programs, you can easily trim your monthly grocery bill. And even saving $100 a month is $1,200 per year back in your wallet!

2. Slash Your High-Interest Debts With These Companies

When the cost of living goes up, the last thing you want is to be tackling high-interest debts like credit cards or personal loans.

However, there are numerous debt relief companies out there that are helping people with $10,000 or more in debt finally become free.

Here’s how these companies work: they start by consolidating all of your debts into one single payment with a much lower interest rate. In some cases, this reduces people’s monthly payments by 30% to 50% or even more. And in the long run, you can save thousands of dollars in interest payments alone.

Some families are even becoming debt free in as little as 12 to 36 months. Getting started is also free and just takes a short online application.

The best part? Many of the top nationwide debt relief companies don’t charge any fees until you become debt free and have realized savings in your pocket.

👉 See if you qualify for fast debt relief assistance!

3. Earn Gift Cards & Cash By Completing Easy Online Tasks

How does an extra $600+ per month sound?

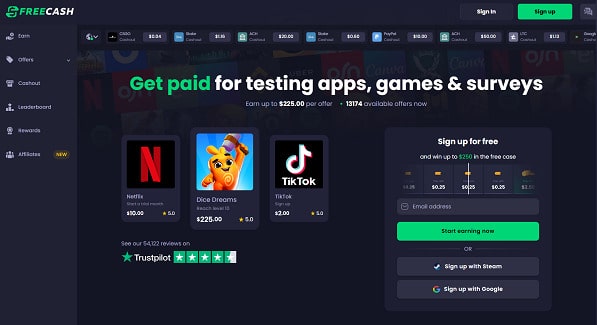

Pretty sweet, right? Well, this is what people around the world are enjoying thanks to a new rewards platform called Freecash.

This site pays its members for completing simple online tasks like answering surveys and playing games. It also lets you earn with shopping offers, downloading new apps, and surfing the web.

Right now, members are earning over $20 a day on average just by spending a bit of time on the website. That’s $600+ per month! And you cash out right to PayPal, crypto, or for free gift cards to companies like Amazon.

Signing up is free and just takes your email. Once you’re a member, you can explore 100+ ways to earn and begin making money immediately.

4. Turn Your Smartphone Into An Income Source

When the cost of living is high, creating new income streams is one of the best ways to make ends meet. After all, every extra dollar you make can help you cover bills and get ahead financially.

The great news is that it’s also super easy to boost your income just by using your phone. That’s because there are plenty of gaming reward apps out there that pay you for playing new mobile games in your spare time.

👉 iPhone Users: Earn real cash by playing games of Solitaire on your phone with Solitaire Smash!

👉 Android Users: Get PayPal cash and gift cards by trying new mobile games with Cash Giraffe!

👉 Samsung Users: Play pool on your phone and compete in skill-based games with Pool Payday!

All of these games help people earn extra cash on the side in their spare time. If you’re a fan of gaming, it’s definitely time to turn your hobby into an income source.

5. Start Getting Paid For Sharing Your Opinion

People probably ask you for your opinion all the time. But when was the last time you got paid for sharing it?

Giving away free advice ends today. That’s because this leading survey panel is paying everyday people for sharing their honest opinions.

In fact, this site is paying $55,000+ to members in daily rewards. To get in on the action, you just need to sign up with your email and then answer surveys in your spare time. From there, you cash out through PayPal or with dozens of free gift cards.

Surveys can ask anything and include topics like sports, entertainment, food, and music. Answering just a few per day can easily be an extra $200+ per month in rewards.

6. Stop Wasting Money On Your Phone & Internet Bills

Has it been a while since you’ve called your phone or internet provider to negotiate a lower bill?

If you’re like most people, it’s probably been a while! But when the cost of living is high, every dollar counts, so it’s important to be frugal and cut down on spending.

Luckily, an app called Rocket Money is helping people do just that.

This all-in-one money app helps you automatically create a budget and track your spending. It also detects unused or overly-priced subscriptions and helps you cancel them to find instant savings.

What’s more is that Premium Members get access to Rocket Money’s “Concierge” service. With this feature, Rocket Money’s team contacts your phone and cable providers and negotiates lower monthly bills on your behalf. Plus, its team can cancel unwanted subscriptions for you and even works with your bank to reverse late fees or overdraft charges.

It’s like having a money-saving assistant on your side at all times.

Pro Tip: The app is free to download, so it’s easy to check it out to see if it works for you. However, The Budget Diet recommends upgrading to Premium which costs at little as $4 per month to maximize savings.

🚀 Download Rocket Money For iOS or Android today!

7. Break Up With High Bank Fees For Good

When living costs are high, bank fees are another pesky financial drain you need to get rid of.

There’s also zero excuse for sticking with a lackluster bank these days. After all, the top banks out there are often fee-free and pay as much as 5% APY or even more on deposits.

Need a helping hand in finding your next bank? Raisin has you covered.

This online savings marketplace helps you find the best high-yield savings, CDs, and money-market accounts on the market. It doesn’t charge any fees either, and there’s a $1 minimum account opening requirement so anyone can get started.

Raisin partners with 40+ banks and credit unions to bring competitive savings rates to its members. So, make the switch to a no-fee bank that actually pays its customers if you’re tired of your bank.

8. Protect Yourself From Massive Repair Bills With A Home Warranty Plan

A lot of homeowners don’t realize this, but your homeowners insurance doesn’t usually cover major appliances and systems.

If your AC goes bust or your fridge stops working, this means you’re suddenly out of pocket for the expense…Not good news when you’re trying to reduce your cost of living.

To avoid thousands of dollars in potential repair bills, we suggest going with a home warranty plan from a company like Choice Home Warranty.

This leading company already covers 2+ million homes across the country. And with its network of 25,000+ contractors, you can get immediate assistance when one of your appliances or home systems needs a repair.

From plumbing and electrical to major kitchen appliances, Choice Home Warranty helps you cover the most important (and expensive) aspects of your home.

Getting a quote is free and just takes a bit of information. And right now, Choice Home Warranty is giving away its first month for free when you sign up with any single payment home warranty plan.

👉 10+ Ways To Make Extra Money Without A Job.

9. Consider Downsizing Or Relocating

One more tip to reduce your cost of living is to consider downsizing or even relocating.

Downsizing is often an effective strategy for couples or individuals who have become empty-nesters or who are approaching retirement age. As for relocating, moving to a low cost of living (LCOL) city or state versus a high cost of living one can save an immense amount of money in the long run.

👉 8 Must-Know Shortcuts To Becoming Debt Free.

10. Add These Frugal Hacks To Your Life

Still trying to lower your cost of living? Don't sweat it.

Here are some of our all-time favorite frugal hacks you can add to the mix to cut costs even more:

- Lower the thermostat in your home to save on energy

- Ask these nice companies for financial assistance

- Live with a roommate or rent out a spare room

- Start making more meals at home (or look for free food deals)

- Try biking or walking instead of driving everywhere

- Don't be afraid to haggle or negotiate

- Use less water with shorter showers to lower your monthly bills

- Start shopping at thrift shops

- Start buying in bulk when you find a good deal

- Sell stuff you don't need with a garage sale

- Use these methods to get free gas cards

- Visit your public library for entertainment

- Switch to no-name brands or try shopping at wholesale clubs

- Try a no-spend challenge for a month

- Apply for government benefits and hardship grants

- Create a household budget

- Start making coffee at home

- Avoid impulse shopping and don't shop for food when you're hungry

- Dry your clothing outside when it's sunny instead of using the dryer

- Learn simple home repairs to save more money

- Reduce or eliminate spending on things like alcohol or smoking

- Always eat leftovers and try to reduce food waste

- Add some low-cost meals to your weekly plan

- Add a passive income stream to your life to make ends meet

👉 12 Proven Ways To Get Free Money.

Final Thoughts

There are proven ways to reduce your living expenses. And these tactics are incredibly important when the cost of living keeps rising.

So, pick one or several methods and apply them to your daily routine. With just a bit of effort, you can realistically boost your income while lowering how much you spend per week. Together, this can help you and your family get by even when things are a bit more expensive out there.