Tax season is here again. This time of year can be anxious for most people. Tax preparation is a complex science of inputting personal information like income, dependents, and expenses. There are loopholes and tax breaks like the child tax credit that can be used to lower your taxes or even get a refund.

But all these rules are hard to know unless you’re a tax expert. And with all due respect to CPAs and accountants, reading the IRS handbook is not exactly an enjoyable pastime. So how can the average taxpayer make sure they are filing their taxes correctly, while also capitalizing on their tax refund?

Thankfully there is tax software like TurboTax and H&R Block. These software options will guide you through the process of tax filing. They’ll prompt you about inputting the right info and claiming the breaks you deserve in your given tax situation.

You don’t need to be a tax pro to use them; you just need an internet connection. Of all the choices out there, two are most commonly spoken of. But which one is the best tax software: TurboTax or H&R Block? Let’s take a look.

About TurboTax

TurboTax is the consumer-facing software made by Intuit. Like their other apps—Mint and Quickbooks—it’s very much geared toward the average taxpayer: someone receiving paychecks as an employee. Intuit is also the name behind Credit Karma. For individuals whose income is more complex, such as business owners and those who are self-employed, there are different TurboTax products with more bells and whistles.

TurboTax Pros

- Easy user interface

- Stellar CPA support

- Free for most tax filers

- Accessible via phone app

- Integrates with Mint and QuickBooks

TurboTax Cons

- Potential upselling

- State returns often cost more

- Added costs for complex returns

- Limited customer support for free returns

About H&R Block

Since 1955, H&R Block has been primarily known for its brick-and-mortar retail storefronts. Tax filers can pop in and have an actual accountant prepare their tax return. But around 30 years ago, H&R Block created software for in-home tax filing. And 5 years ago they started giving customers the option of uploading all their paperwork for an accountant to do their taxes (instead of walking into a storefront).

H&R Block Pros

- “No Surprise Guarantee”

- The option for in-person help

- Fee-based accuracy review by professionals

- Accessible Through a Phone App

H&R Block Cons

- Limited free options

- Limited customer service for free returns

- Deductions may prioritize their fees over your refund

Tax Products

Now that we’ve introduced the companies, let’s do a more in-depth TurboTax versus H&R Block review. TurboTax and H&R Block software obviously have similar end goals in mind (helping you file your taxes). But the way they go about it is different (and looks different).

TurboTax

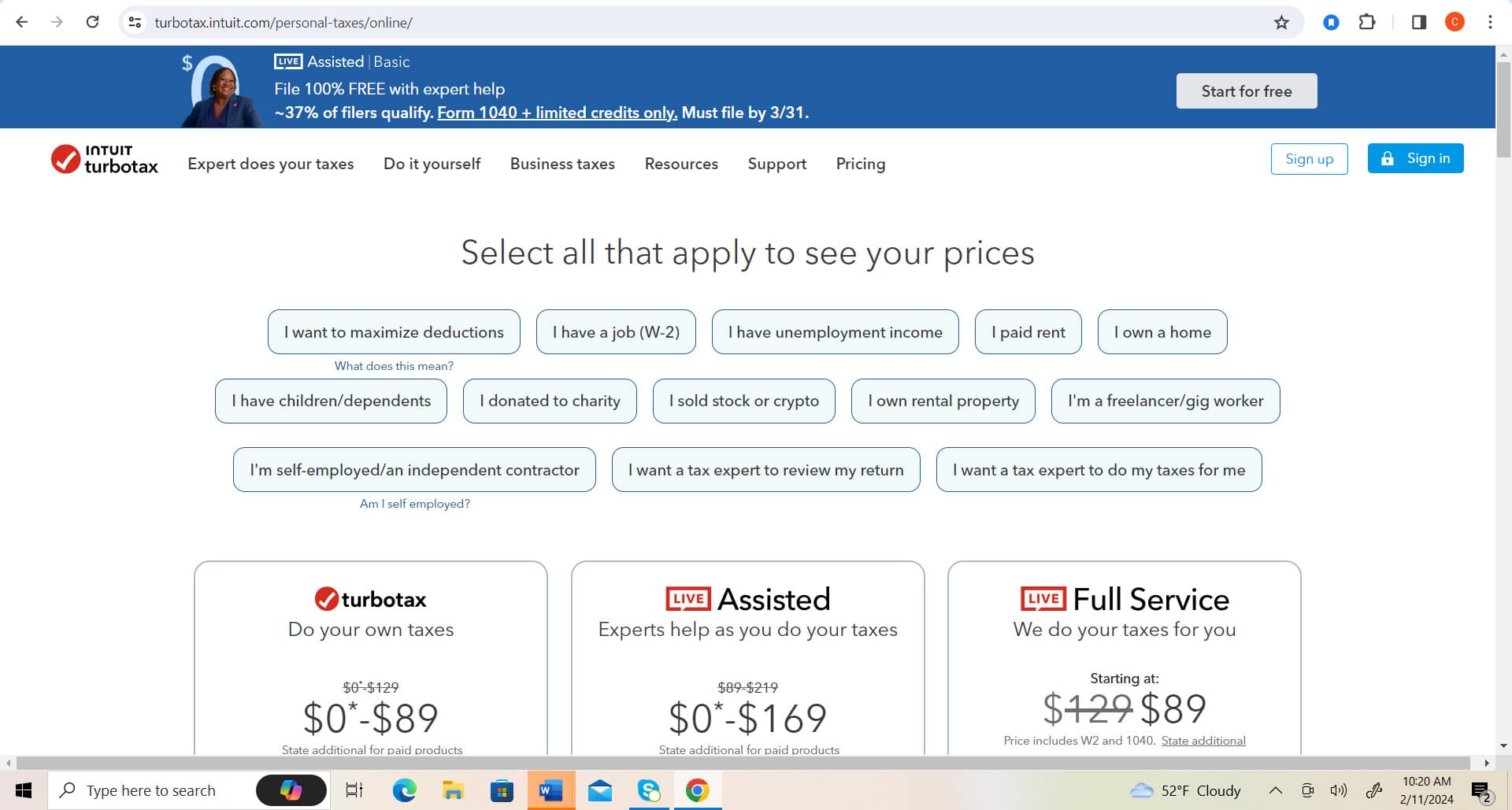

You can purchase TurboTax software at a local retailer like Target, or head straight to their website. As you can see, the user interface is very user-friendly. It’s almost like more of a conversation than filling out a form.

You can select the filters that most accurately apply to your income situation, and the price brackets will change accordingly. There are literally hundreds of different combinations that could impact your pricing, but let’s take a look at a few common ones.

| Situation | Basic | Assisted | Full Service |

| I am a W2 employee | $0 | $0 | $90 |

| ● I am a W2 employee

● I have dependents ● I want to maximize my deductions |

$39 | $89 | $159 |

| I am…

● A freelancer ● A gig worker ● An independent contractor ● Self-employed |

$89 | $169 | $389 |

| ● I own rental property

● I want to maximize deductions ● I want an expert to review my return |

$89 | $169 | $289

|

Keep in mind that even the most expensive options allow you to start for free. You only pay when you complete your filing. And for many filers, it will ultimately be a free file. However, also keep in mind that there may be additional fees and prices for your state tax returns.

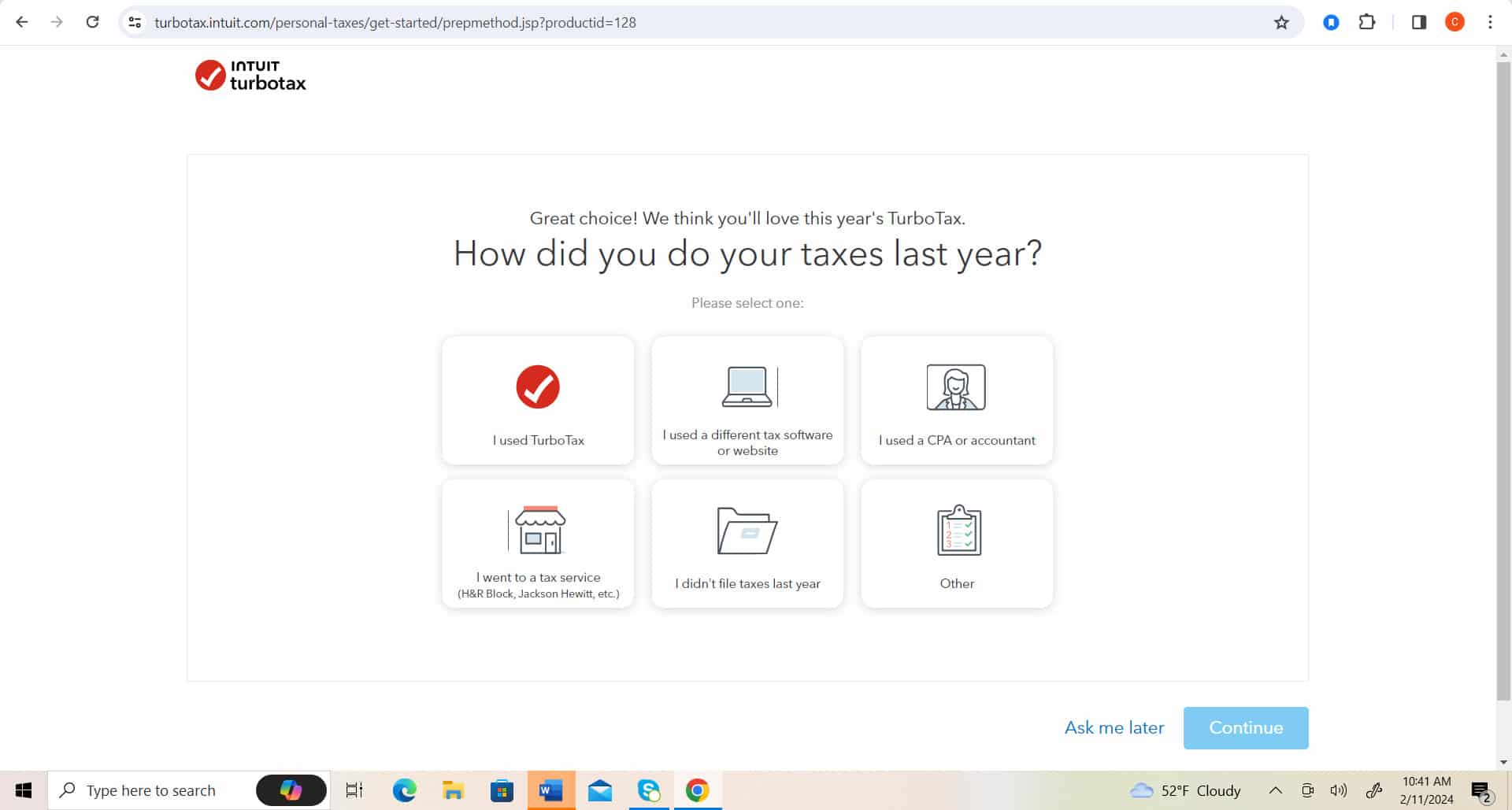

After you select which option applies to you, you’ll need to either log in or create an Intuit account. From there, you’ll be prompted to upload your tax documents like your W-2. With TurboTax, you can even upload these documents using the app.

H&R Block

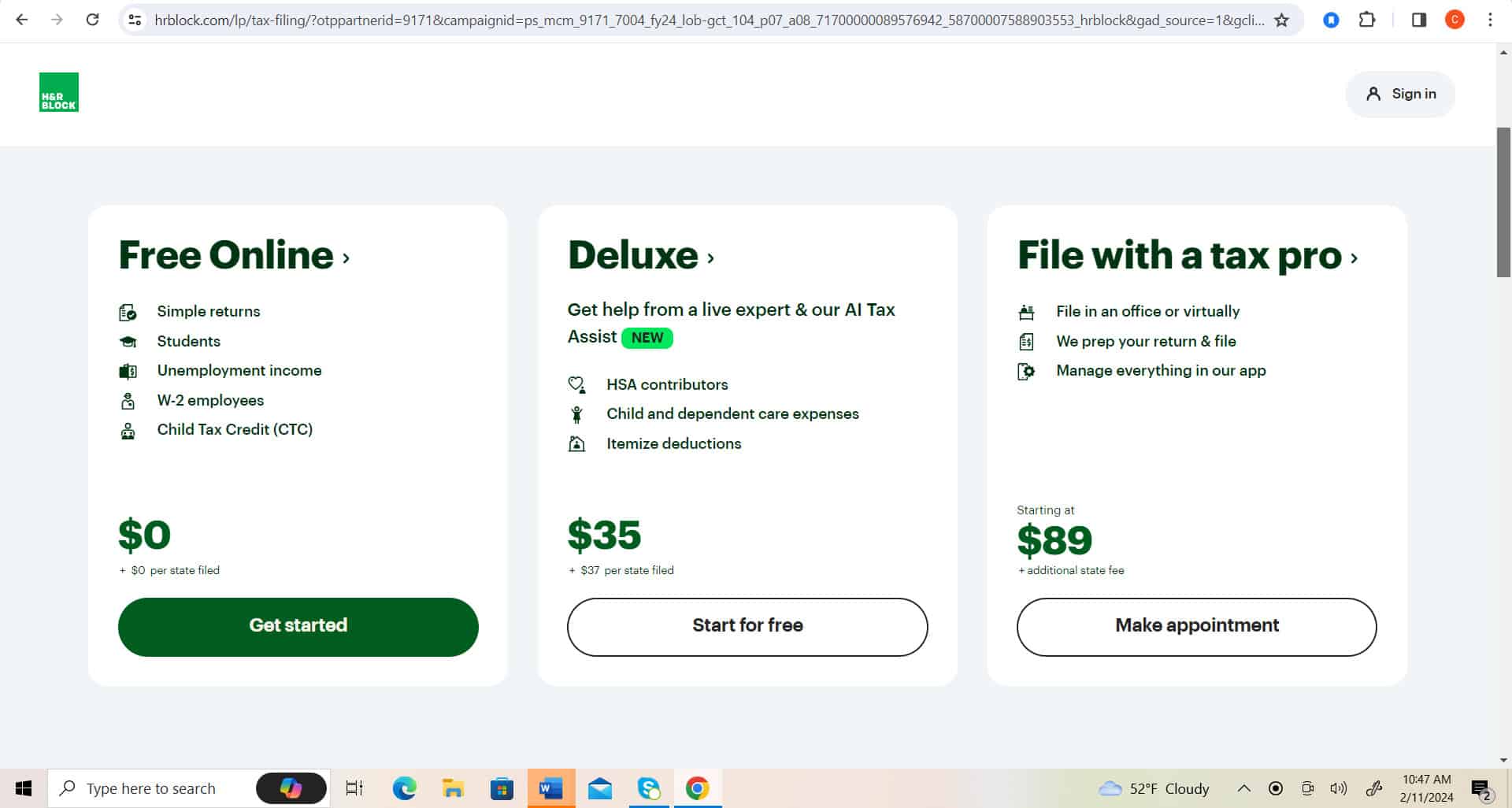

The banner at the top of the H&R homepage says it all: Online and in-person, help is here. Remember that H&R Block has retail stores you can actually walk into if you decide you want some questions answered in person.

But if you’re fine filing online, the prices are very straightforward. There is a free online version, and different levels going on up to H&R Block deluxe products. You also have the option of downloading the software, so you can use it multiple times (5 times, to be precise).

| Package | Includes | Price |

| Basic | ● Federal taxes only

● Real-time refund results ● 5 free federal e-files |

$25 |

| Deluxe + State | Everything above plus…

● Federal & state returns ● ONE state return ● Itemized deductions |

$49 |

| Premium | Everything above plus…

● Rental property income and expenses ● ONE state return ● Complex returns like those that include Form 1099 |

$75 |

| Premium & Business | Everything above plus…

● Personal and business taxes (e.g. C-corporation) ● ONE state return ● Easy expense tracking |

$89 |

If you don’t want to download the software, and you just want to file your taxes online, the prices are a little different. Simple returns start at $0, while self-employed returns (business owners, freelancers, rideshare, and delivery drivers) are $85.

Want an expert to check your work? Check out these prices, which vary based on your situation:

| Situation | Pricing for Expert Review |

| Simple tax returns (e.g. W2 employees) | $55 |

| Filers with dependents | $100 + $37 per state |

| Investors and rental property owners | $160 + $37 per state |

| Self-employed and business owners | $180 + $37 per state |

Customer Service

Does the free version of these software products come with customer service? It does indeed. But how good is it? “Free edition” might not sound like it provides comprehensive coverage. And indeed, it doesn’t. TurboTax and H&R Block free products have limitations in terms of phone-based or chat-based help. But both companies offer tax pro guidance if you need it.

How to Contact TurboTax

TurboTax has FREE expert help for some filers. Around 37% of taxpayers filling out a Form 1040 qualify. Before you submit your return, an expert will review it as well. Want to speak to someone on the phone? You can call 888-777-3066. There is also a live chat and a customer support page.

TurboTax experts are available from 5:00 AM to 5:00 PM, Monday through Friday. During tax season, they are available until 9:00 PM. Basic tech support is free (e.g. issues using the software or online filing). However, the price for actual help with the content of your return will vary based on its complexity.

How to Contact H&R Block

H&R Block offers a robust support page if you need help. Want to speak to someone on the phone? Call 800-472-5625. There is also a live chat option. Phone support is available from 7:00 AM to 10:00 PM central time, Monday through Friday. The live chat is available from 7:00 AM to midnight, all week.

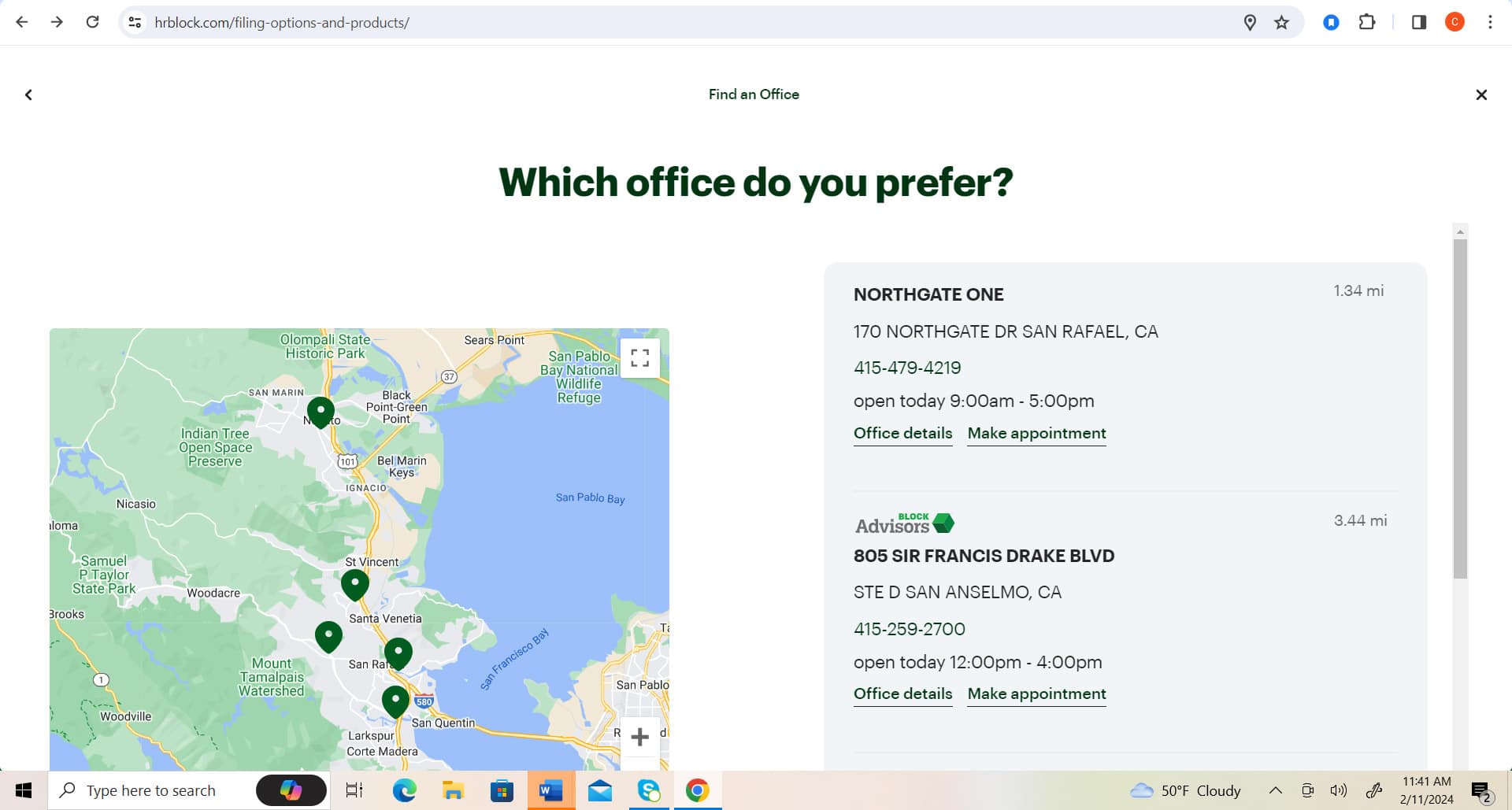

Then there are the H&R retail stores: https://www.hrblock.com/tax-offices/local/

If you type in your zip code, you will get a list of the 12,000 locations across the United States that are close to you. You can call directly or click to make an appointment.

Keep in mind that H&R Block and/or TurboTax online or phone assistance has its limits. A tax pro review will look over your return. They are not going to add up all the numbers that went into your return.

For instance, if you collected payments on Cash App, PayPal, or Zelle, your standard customer service rep is not going to add those numbers up for you and separate them from the payments you sent. If you don’t want to do all that legwork, you’ll need to get your own accountant.

There is a TurboTax live full-service option, and there are H&R retail storefronts. Both these options provide more comprehensive customer service. They may be able to assist you in rounding up all the numbers. But the TurboTax free edition and the H&R Block free online software require you to do some of this legwork.

This conversation only applies if you are a gig worker, self-employed, or contract worker. If you have a straight W2 on a payroll, your return (and rounding up the numbers) will be much easier. The basic H&R Block software or TurboTax online platform should be sufficient in terms of customer service. It’s tempting to dive into more customer service comparisons like FreeTaxUSA vs TurboTax vs H&R Block. At the end of the day, they will all have limitations about how far they can go.

Refunds: TurboTax vs H&R Block

Both H&R Block and TurboTax assist in setting up tax refunds to your bank account. They will need a few pieces of information to facilitate this: your bank account number, and your bank’s routing number. These numbers are located on the bottom of paper checks.

However, most consumers do not use checks anymore. If you need to locate these numbers, try your banking app. There should be a tab you can open that will display the full routing and account numbers.

How Does H&R Block Issue Tax Refunds?

H&R Block has a unique Refund Transfer that allows you to use the refund to pay for your tax filing. If you have a more complicated return and want a manual review, this could add up to a few hundred dollars.

You can elect to have this amount deducted from your refund when it arrives. You can get the remainder of the refund as a direct deposit or into a Spruce account (H&R Block’s mobile banking app). Assisted tax prep clients can request a paper check or a prepaid Mastercard.

How Does TurboTax Issue Tax Refunds?

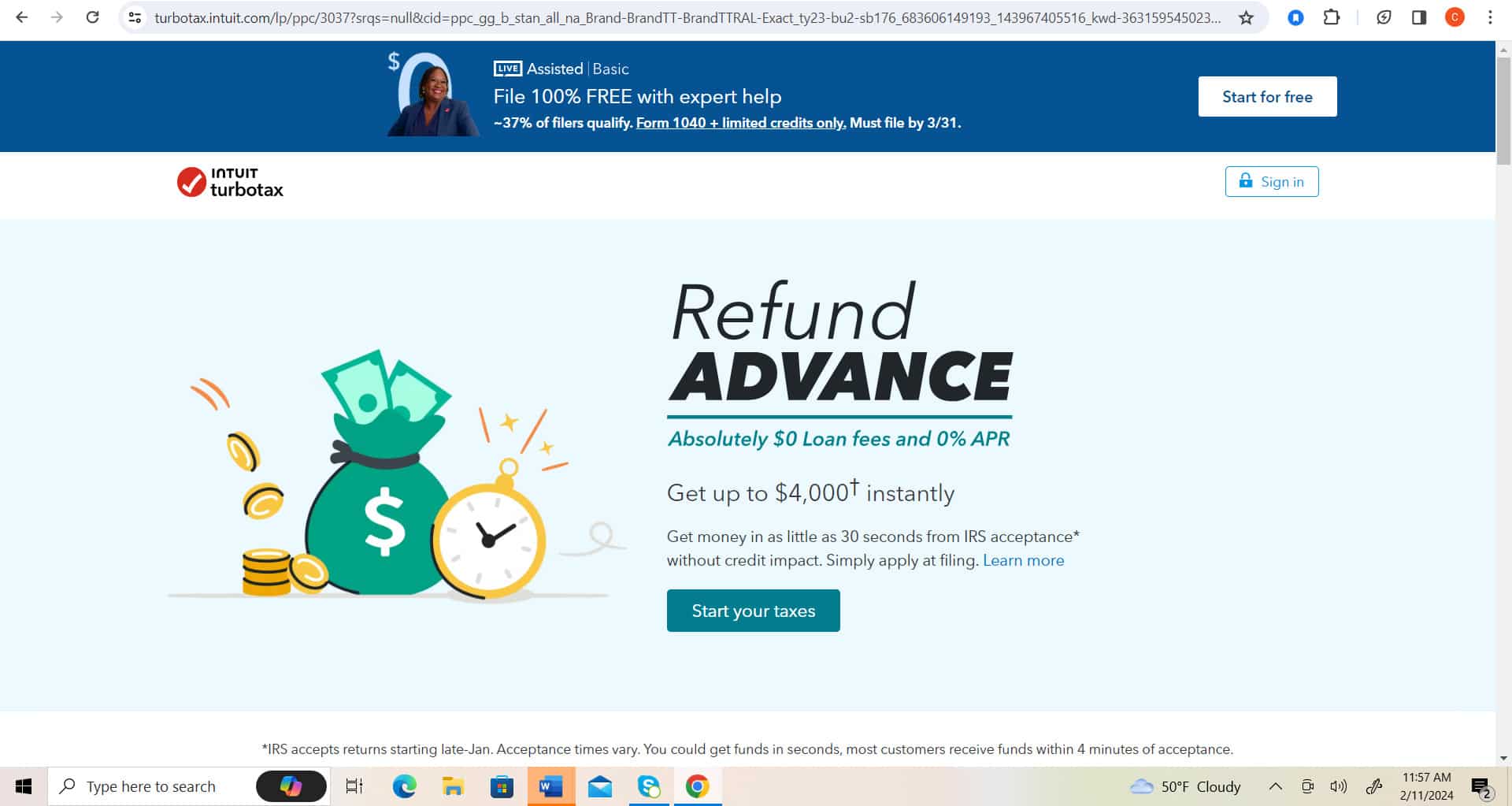

TurboTax can also facilitate refunds via direct deposit. Some filers may be able to enjoy an advance on their refund for up to $4,000. Keep in mind that refunds are issued by the IRS, so an advance would be coming from a third-party lender (in other words, it’s a loan).

Many consumers like to use tax refunds for home improvement projects, or to clean up their credit card bills from the holiday season. Whatever you’re using it for, the TurboTax advance option might be a great way to get that money now, as a sort of personal loan.

TurboTax has a refund tracker and suggests that you’ll get your refund within 19 days. If for whatever reason you don’t want a direct deposit, you can get a refund issued as a check, bond certificate, or credit towards next year’s taxes.

In most cases, there is no difference between the H&R Block online free version and the H&R Block premium version when it comes to the speed of your refund. The same is true of TurboTax and TurboTax deluxe products. The difference between these products is more about the filing process itself, and the complexity of your tax filing. The speed of the return itself is really more contingent on Uncle Sam.

You could continue to research Liberty Tax vs H&R Block and so on, but the speed of your return is not going to be much different. The TurboTax instant refund advance is a really unique option among refunds.

Payments

How do you issue payments to the IRS if you are not getting a refund, but owe them taxes? When you complete your tax return, you may be prompted to make a payment at the time the return is completed. However, in some cases, you will not. It all depends on your tax return and the level of guidance you requested (e.g. self-guided versus professional assistance).

H&R Block has several options. You can pay with a Visa or Mastercard through their third-party payment processor, the aptly named Payment1040. Be advised that there will be a 2.49% convenience fee for plastic payments. You can use IRS Direct Pay to pull money from your checking account via an ACH transfer.

You can also issue a check to the IRS yourself. In this case, neither H&R Block nor TurboTax collects or facilitates the return. These are mailed directly to the IRS. You’ll need to write some additional identifying information on the check like your SSN and daytime phone number in the memo field, and include a payment voucher.

When you are done filing your TurboTax return, if you owe taxes you will have several options for paying them. You could pay the IRS directly via check or ACH, and TurboTax will provide you with links and instructions to do so.

Or, you could pay using a credit or debit card through TurboTax’s payment processing partners: Link2Gov and WorldPay.

Also keep in mind that if you can’t pay your tax bill all at once, the IRS does allow you to enroll in a payment plan.

What about paying your state taxes? Different states may have different ways of collecting payment, so there is no one-size-fits-all (or even most) answer here. Some states don’t have income tax at all. Other states may only take checks or ACH transfers, while some states may allow you to pay with a debit or credit card.

H&R Block says that the people who give tax support and check the tax returns submitted for Tax Pro Review are graduates of the 60-hour Income Tax Course of the company and are required to complete a minimum of 18 hours of continuing education and an average of 20 hours of skills training regarding policies and procedures each year.

According to the company, the tax pros who are handling Tax Pro Review returns are “certified at H&R Block’s highest levels and are our most tenured and experienced tax professionals.”

H&R Block and TurboTax offer the best support options available on the market. H&R Block may be the better option if you want more ways to have face-to-face support. TurboTax also has a lot to offer to filers who are comfortable with getting online advice, and both providers give their users access to actual tax professionals.

Audit Protection

Audit protection is also a feature that is promoted by many tax-prep companies. The level of service usually varies, so you must read the fine print. In general, there is guidance (which basically helps you understand what is happening once you are audited) and representation (which means that someone from the company will talk with the IRS on your behalf). Most preparers offer free guidance. However, if you want to be represented by someone, you have to pay more.

TurboTax

If you receive an audit notice, you will receive free guidance on how to prepare and what to expect. But if you want someone to represent you in front of the IRS, you will be required to buy the “Audit Defense” product of TurboTax when you file. The product costs $39.99.

H&R Block

Users of H&R Block can purchase a type of combo product called the Worry-Free Audit Support which allows you to have one-on-one contact with a tax professional to help guide you through an audit. The Worry-Free Audit Support costs $39.95. It includes in-person audit representation, IRS correspondence management, and audit preparation.

If you only want the cash coming from your refund, both these companies can easily get it done.

TurboTax Versus H&R Block…Which is Better?

To be honest, both products are fairly comparable, especially for the vast majority of taxpayers with simple returns. It will really come down to basic things like the user interface. Some filers will prefer the look and feel of TurboTax, while others will prefer H&R Block, just like some consumers prefer Coke and others Pepsi.

However, there are some situations in which there is a clear difference. For starters, the TurboTax tax return advance is an incredibly helpful option for individuals who want their return now. Since H&R does not offer something similar, this gives TurboTax the advantage for filers who want to get their hands on the return as soon as possible.

On the other hand, H&R Block is better poised to help consumers who want hands-on support. Consumers who are anxious about maximizing their deductions or who have complicated filing situations (self-employed, C-Corp, landlord, W2, and part-time gig worker), may find more solace working with H&R—especially because they can always (if they want to) meet a tax advisor in person. For these filers, H&R might be the best place to get your taxes done cheap.