Technology has made us see and experience numerous great advancements in terms of financial tools. There are currently more tools than ever before that make it easier for us to invest using smaller amounts of money. Two of today's favorite, easy, low-maintenance, and high-quality investment apps are Stash and Acorns. The said apps work a little differently from each other. However, both can be used consistently to help the users reach their savings goals.

The rise of smartphones has also revolutionized the way people manage their finances – from bills payments to credit score tracking. Thanks to a series of new investing apps, it has never been easier for neophyte investors to start investing in the market. Various applications for micro-investments have been introduced to the investment world in the last couple of years.

Acorns and Stash Invest are investment apps that are smartphone-based that enable their users to save and invest very little amount of money. The apps then offer professional investment management that can help you invest and improve your portfolio.

The two applications enable their users to invest even very small sums of cash. In doing so, the user can accumulate an investment portfolio without even knowing that he is actually doing it. Both apps also enable their users to invest further amounts so that you can easily fast forward the progress of their investment.

Both services are also available as mobile apps, which means that the users can easily invest on the go. Both apps offer investment management; however, Stash Invest is considered to be more democratic in this regard and of course both have fee structures that are identical.

Acorns Overview

Acorns is an investment app that rounds up the purchases of the users to the nearest dollar and then transfers the difference straight into the investment account of the user. It also allows you to directly make investments if you would want to invest more than just your spare change.

Acorns calls itself as the first mobile investment application that allows its users to open an account via their smartphones. Acorns will literally let you invest your “spare change.” You can do this by simply connecting your mobile phone to your credit cards and bank accounts, and the application will invest your change automatically. There is no limit to the number of credit cards and bank accounts that you can link.

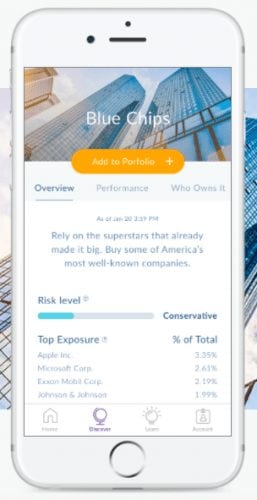

The main selling point of Acorns is how easy it is for users to choose their investments. To get started, Acorns will ask you for your age, your income, how long you are looking to invest, your financial goals, and risk tolerance. From there, the app recommends one out of five portfolio blends. Each portfolio comprises of six low-cost exchange-traded funds (ETFs). The portfolios range from conservative or those with a larger allocation of bonds to aggressive or those with a larger allocation of stocks.

The “spare change” that Acorns allow you to invest is small amounts of money that are often less than a dollar. These add to your Acorns investment account every time you make a purchase. For example, let us say that you recently purchased a latte from Starbucks for $5.50. The purchase will be rounded up to $6, and 50¢ of that will go into your investment account automatically. In that way, small amounts will be invested for every purchase, allowing you to save money without even noticing that it is actually happening.

Acorns refer to this method as Round-Ups, since the price of the purchases of the user is rounded up to the next increment. The user can round up the amount to the nearest dollar or opt for a higher amount so that growth in their investment will be realized even faster. The user can also set scheduled investment deposits, which can occur either daily, weekly or monthly.

Acorns is available for both Apple and Android devices. The app looks good and performs flawlessly – it gives the users the access to everything they need to buy, sell, or change portfolios.

Users can easily add or remove money on the go, using their phones. It also has a desktop PC support, so it makes it easier for users full cross-platform access.

How Much Does It Cost To Use Acorn?

Just like any product that is aimed at convenience, the investing platform of Acorns comes with a tag price. The service charges its users $1 per month for accounts that have investments of $5,000 or less. On the other hand, it charges an annual fee of 0.25% of the account value for balances that are over $5,000.

If you are under the age of 24 or is attending college or a university, the service will be free to use. It is worth noting that there are no commissions when you choose to purchase shares in ETFs.

Opening an account with Acorn is free of charge, and you can begin investing with even only $5.

Can Acorns Serve As A Retirement Account?

The answer is no. The services of Acorns only offer individual non-retirement accounts – this means the user cannot make use of Acorns to open an IRA.

Who Should Use Acorns?

If you are a student in college or the university, you should immediately sign up for Acorns because college students receive up to four years of access FREE – which is equivalent to $48 free dollars, if you sum it up. Acorns serves as a fantastic tool for people who consider themselves more of a spender than a saver. Its services make saving automatic and effortless.

Features That Are Unique to Acorns

- No Minimum Deposit — users can easily open an account with Acorns even without money.

- Web Access — With Acorns, a user does not only have access via an app on their smartphone but also via their website as well.

- Found Money — The user can save money on items that they purchase. Acorns is currently running beta testing in partnership with several brands, which includes the Dollar Shave Club and 1-800 Flowers, with more brands on the way, in which the retailers will also invest in the Acorns account of the user.

Making Withdrawals From Acorns

Withdrawing money from Acorns is free of charge. However, it will take some time to be transferred to your bank account. The company says that the withdrawals usually take a maximum of seven business days.

That is because Acorns is required to sell the bonds and stocks from your account in order to accommodate your withdrawal. This process could take a maximum of three business days alone. The company then transfers the funds to your bank account, a process that could take usually a maximum of three days.

Acorn Portfolios

Once you open up your account in Acorns, you will be asked to provide your personal financial information. The information will then be used as the basis to create a recommended portfolio that is best suited for you.

The platform lets you choose different investing goals, which includes long and short-term investments, a major purchase, children, or any general information. Based on your financial information and those goals, your portfolio will then be constructed around your tolerance for risk, which is as follows:

- Conservative

- Moderate Conservative

- Moderate

- Moderately Aggressive

- Aggressive

You can choose for the asset class that you would want to invest in, which will then be represented by a corresponding exchange-traded fund (ETF). Your portfolio in Acorns is constructed from six ETFs that will represent most of the global investment world.

This is what is known as the modern portfolio theory, or the MPT. This theory believes that asset allocation is more essential to investment success compared to individual security selection. Since your portfolio will cover the six most important asset classes, the related ETF that is being based on an asset class index will represent a broad diversification into stocks and securities in every class.

ETFs Available Through Acorns Include:

- Small Company Stocks — Vanguard Small-Cap ETF (VB)

- Large Company Stocks — Vanguard S&P 500 ETF (VOO)

- Real Estate — Vanguard REIT ETF (VNQ)

- Emerging Markets — Vanguard FTSE Emerging Markets ETF (VWO)

- Government Bonds — iShares 1-3 Year Treasury Bond ETF (SHY)

- Corporate Bonds — iShares iBoxx$ Investment Grade Corporate Bond ETF (LQD)

Acorns Minimum Deposit

Acorns will not require you to have a minimum deposit. You can simply open an account with Acorns today, link up your bank account or your credit card and start investing immediately.

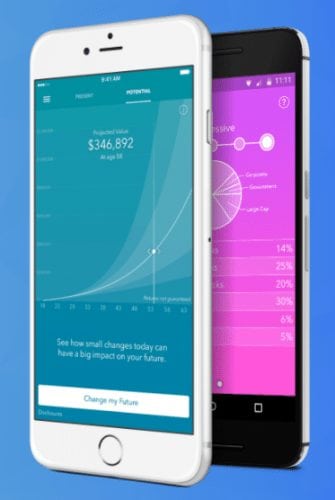

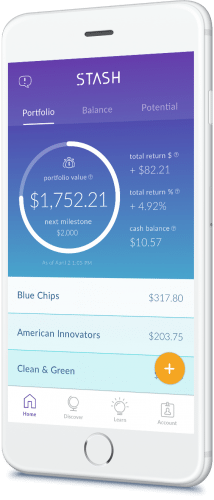

Stash Overview

Stash Invest is an automated investment application that is designed for your smartphone. A user can invest with as little as $5, which makes the app a micro-savings application. Unlike Acorns which actually performs the investing for you, Stash Invest simply makes investment recommendations that are suitable for you, leaving it up to you to decide and do the actual investing.

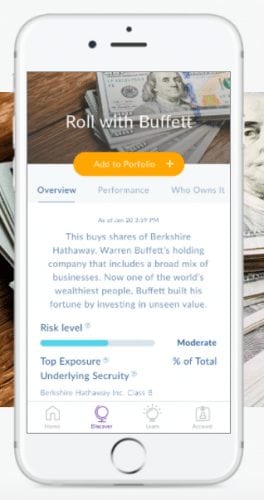

Your investment portfolio in Stash can be a combination of various investment themes, which are comprised of exchange-traded funds (ETFs) that are set in an asset allocation that is consistent with your chosen theme. Stash gives those themes some creative names that include “Delicious Dividends,” “Defending America,” “Live Long & Prosper,” and “American Innovators.”

Stash is also described as an investment app that makes investing easy, fast, and best of all, cheap. They have more than 30 ETFs that are available with low expense ratios, so more of the money that you invest actually gets invested. It allows you to invest in any variety of funds and set up automatic purchases in order to take the hassle of investing out of the life of its users completely. You just simply have to set it, forget about it, and watch your wealth build.

Stash is more clunky, and has a higher learning curve. Even though it has a basic website that provides general information, one downside of Stash is it fails to offer PC support – meaning it gives no access to the account of the user from their desktops.

How Much Does It Cost to Use Stash?

Similar to Acorns, Stash charges its users $1 per month for accounts that are under $5,000. Accounts that have a balance of over $5,000 are charged with a 0.25% fee. Opening a Stash account is free of charge, and you can easily start investing with even as little as $5.

Can Stash Serve As A Retirement account?

Stash is said to be soon expanding into retirement accounts. However, they only currently offer individual non-retirement accounts. Thus, this implies that you cannot make use of Stash to open an IRA for now.

Who Should Use Stash?

Stash is best suited for people who wish to learn more about investing without allocating their life savings into one particular fund or stock. With Stash, you will be able to get a variety of investments without being required to make any long-term commitments.

It will also save you from dealing with the complexity of working with robo-advisors. There are also some quizzes that you can take to learn which investments are the closest to your needs so that you can receive additional guidance if ever you need it. It is free of charge for the first month, so there will be no harm if you give it a try.

Currently, Stash Invest only has mobile apps for Android and the iOS, so if you want to access the platform via a web browser, then you are currently out of luck. Thus, this leaves out many users who still like to access websites through their desktop computers. Although the target audience of both Acorns and Stash are Millenials who use their smartphones as their primary and only device, this is considered as a limitation when using Stash Invest.

Features That Are Unique to Stash

- Auto-Stash – Users can place their investments on auto-pilot and invest in the things they like weekly or monthly.

- More Flexibility Investing — In addition to the acceptance of investment recommendations from Stash Invest, a user can also supplement their portfolio with their own investment choices. This will provide them with more option for investment.

- Stash Learn – Through the website and the app, Stash offers financial education to help teach novice investors the basics so that they are able to do it themselves.

Making Withdrawals From Stash

Withdrawing funds from Stash is free of charge and penalty-free. However, withdrawals are capped at $10,000 per day. Withdrawals will take a maximum of three business days to process before the funds become available in your bank account. The company says that the process might take a few more days if ever you are required to sell some of your investments first.

Stash Portfolios

Just like Acorns, a user is required to answer a risk tolerance questionnaire for Stash Invest. From there, the platform will provide the user with a list of investment options that they can choose from. The advantage here is that you also have the option to add some investments that are of your own choice to the mix – this differs from a majority of robo-advisors, including Acorns.

The risk tolerance of a user is determined based on their age, their investment goals, and their time horizon. The user will be evaluated as conservative, moderate, or aggressive. Investment recommendations will then be shown depending on their risk tolerance level.

After which, the user will be presented with a choice of 30+ investment themes that match their risk level. It is worth noting that Acorns limit investments to only six ETFs while Stash Invest takes advantage of more than 30 ETFs.

Stash Minimum Deposit

Stash Invest requires its users to have a minimum deposit of $5.

Conclusion

Overall, we can say that it is a close fight between the two. Stash may have some features that some individuals might prefer as it offers more flexibility on your investments, Acorns, on the other hand is easier and simpler to use for neophyte investors.

Acorns and Stash are both functional. They have minimal differences, and offer you easy ways on how to invest your money. Whatever platform or service you choose to use, it is essential that you examine and review your investment portfolios on a yearly basis so that you can make sure that fees and charges of your selected platforms are not too high and that they have the investment choices that you want.

Robert Farrington, the founder of an investing and personal finance site aimed at Millennials that is called TheCollegeInvestor.com, said: “These apps are designed to be a kickstarter to help you get started, but they might not be able to get you to the next level.” Farrington believes that investing apps are overall positive, “In general, the easier companies make it for people to invest, the better it is as a whole.”

Sources:

- investorjunkie.com/48501/acorns-vs-stash/#annual-fees

- bestinvestingapps.com/blog/2017/6/22/acorns-vs-stash

- onesmartdollar.com/stash-vs-acorns-invest-money/

- magnifymoney.com/blog/reviews/investing-apps-acorns-stash-betterment-robinhood884245432/